Over the past year and a half, the Investor Rights Clinic has represented Carroll and Mollie Brown, a retired couple in their 80s who lost half of their life savings in fraudulent investments. Although previously represented by an attorney, the Browns had nowhere to turn after the Financial Industry Regulatory Authority barred the brokerage firm that sold them the investments. The firm left no assets and nothing for the Browns to recover, resulting in the prior attorney’s withdrawal from representation. Fortunately, Mrs. Brown did not give up and found the IRC.

“I was afraid I couldn’t find another attorney so I asked someone who worked at FINRA,” said Mrs. Brown. “The guy gave me the number for the clinic and I said, ‘This is my last shot, but I might as well give them a call. Maybe they will look at my poor old case.’”

The Browns have been married for 46 years. Mrs. Brown has a 10th grade education and worked various jobs before she stopped working to devote time to her family. Mr. Brown has a high school education and worked as a plumber his entire life, until he suffered a broken back forcing him to retire around 2011.

Inital Investments Seemed to Work Well

The couple had no investment experience or knowledge when their broker first approached them. Early in their relationship, the broker scheduled lunches with the Browns around twice a month and often visited them at their home. He recommended that the Browns invest in a variety of investments – including stocks, variable annuities, and insurance products – and established a close relationship with them.

“Everything was great at first,” Mrs. Brown remembered. “He was so nice to us. But after six or seven years I began kind of realizing that something just wasn't right. Things were not on the up and up.”

It was then that their broker began recommending alternative investments such as private placements that the Browns did not qualify to purchase. Private placement investments entail a very high degree of risk and are usually sold only to accredited investors, meaning that the investor must meet certain income or net worth requirements. In the Browns’ case, the broker misstated their net worth as more than $1,000,000 on investment forms to qualify them as accredited investors. The Browns live in a modest home in Sun City Center, Florida, and their only significant asset was the savings that they invested with their broker. Never at any time in their lives had they approached a net worth anywhere near $1,000,000.

Bad Investments and Misrepresentation of Net Worth

So why would a broker misrepresent their net worth? One reason might be the commissions that the investments paid – seven percent or more. The Browns lost money on all the private placement investments their broker recommended, and authorities later determined that two of the investments operated like Ponzi schemes. After losing their prior attorney, the Browns lost hope and blamed themselves for the loss of their retirement savings. “[The broker] put us in such a mess and I felt like it was all my fault,” Mrs. Brown said.

Since the IRC took the Browns in as clients, the supervising attorneys and students have spent countless hours advocating on behalf of the Browns. “I loved the students in the clinic to death,” Mrs. Brown said. “Everyone was so wonderful. They always answered my questions. They always paid attention to me and didn't rush me or make feel like I was a bother. The students always assured me that they were working hard for me and that made me feel great. They all seemed really interested. I felt like we were family.”

Challenge of Going After Defunct Brokerage Firm

The case presented extraordinary difficulties due to the absence of documents from the defunct brokerage firm and the uncertainty of collecting any recovery from an unrepresented individual broker. “I think the biggest challenge would be the fact that we were working with an individual broker instead of a firm,” 3L Angela Capezza said. “We ran into a lot of trouble during pretty much every step of the process.”

Due to their age and deteriorating health conditions, things became more difficult in the Spring 2017 semester. Mr. Brown already had difficulty walking due to his broken back and surgical procedures. Then Mrs. Brown had to be hospitalized due to a serious health concern. The IRC asked for an expedited arbitration proceeding to move the Browns’ case along as fast as possible. With increasing medical bills, the Browns needed to recover their lost savings more than ever.

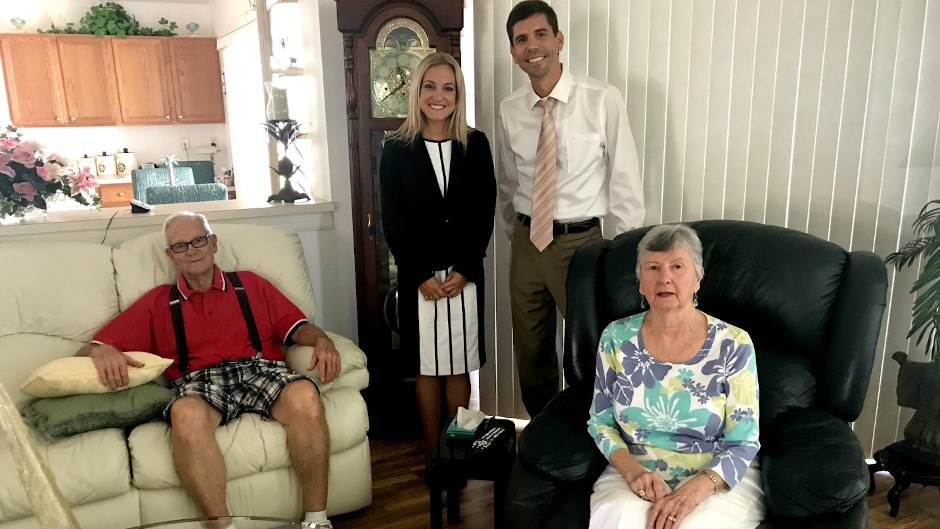

In May 2017, Capezza and IRC Associate Director Scott Eichhorn traveled to the Browns’ home to conduct a videotaped deposition to preserve the Browns testimony for their arbitration hearing in case they were unable to testify.

IRC Secures Partial Recovery of Investments

“I always felt strongly about advocating for them even before I met them in person,” Capezza said. “What stuck out to me the most was being able to see the clients in person and really put a face to a name and a voice that I was talking to and dealing with and advocating for an entire semester. It was really nice to see them in person and see how truly grateful they were for all the work that we had done for them.”

After months of litigation – including discovery, motions, hearings, and preparation for final hearings – the IRC secured a settlement for the Browns to recover part of their damages. Although the settlement replaces only a fraction of their losses, the Browns gained the peace of mind of regaining some of their lost savings and having fought to recover for the harm they suffered.

“You don’t always get the result that you hope for and that you wish for and you believe that you should get, but with enough perseverance and determination, you can get a result for these people who no one would help,” said Capezza.

What to Do About Sketchy Firms

The unfortunate predicament that the Browns faced highlights an important issue under debate in the field of securities arbitration. Brokerage firms that harm investors often go out of business or have no assets to pay judgments obtained against them. Meanwhile, the individual brokers find employment with new firms but often do not have sufficient personal assets to compensate investors for the enormous losses caused by the brokers’ misconduct.

Does Capezza think this is a concern that FINRA should address?

“Absolutely, because it’s unfair that they lost a lot of their life savings and they’re unable to recover just because the firm’s out of business,” Capezza said. “I think FINRA should think about a way to compensate all these unpaid claims. I don’t know how they would do that, but it would be great if they did.”

The IRC is engaged in ongoing efforts to advocate for the adoption of regulatory measures to provide a means of recovery for investors of modest means in situations like the Browns’.

More on the Investor Rights Clinic.