As the most active hurricane season on record ended, Annie Lord, one of Miami-Dade’s leading affordable housing advocates, couldn’t help but worry how much longer the county’s luck will hold. Had 2017’s Hurricane Irma not weakened and shifted westward before ripping across South Florida, she knows the county probably would have lost much of its already-scarce affordable housing.

“We have a serious shortage of affordable housing, and the quality of the stock is old and not particularly well maintained,” said Lord, executive director of Miami Homes For All. “So, as we face the increasing impacts of climate change—like more and more severe hurricanes—we need to do a lot more to ensure that families not only have access to affordable housing but to affordable housing that’s going to last. What good is it if in 10 or 20 years it’s blown or washed away?”

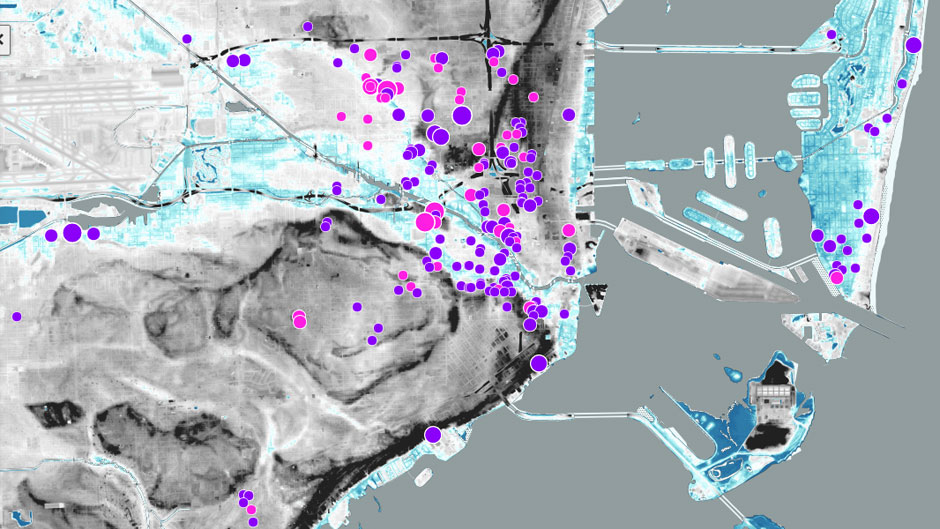

With the goal of avoiding that very real possibility, the University of Miami’s Office of Civic and Community Engagement (CCE) is launching a new version of its Miami Affordability Project (MAP) tool to make it easier to tackle Greater Miami’s two most challenging problems—affordable housing and climate change—in tandem. Made possible by a $300,000 grant from JPMorgan Chase & Co., the 3.0 version of MAP enables users to visualize how the increased flooding, rising seas, and more powerful storm surges projected for the future would impact affordable housing across Miami-Dade—which already has the nation’s highest percentage of renters spending more than half of their income on housing.

The intent, according to Robin Bachin, the University’s assistant provost for civic and community engagement, is to help decision makers, planners, developers, and community advocates plan better. They need to address where and how new housing investments, adaptations, and mitigation efforts should be made in the short term to protect affordable housing from long-term, climate-related threats—which are already tangible. Over the past decade, flooding in Miami-Dade has increased by a whopping 400 percent; and over the next decade, sea levels are projected to rise another six inches.

“There has been a lot of research and data on each of these issues independently but this tool creates an opportunity for us to look at them in unison,” added Jennifer Posner, the CCE program manager who worked with a cadre of experts and stakeholders to augment the MAP tool created in 2015. “We distilled a huge universe of information that is really important in Miami and now this simple and straight-forward tool is universally accessible to everyone.”

One of MAP’s initial and most ardent supporters, JPMorgan Chase has long helped communities across the nation recover from natural disasters but recently began focusing on helping those areas build resilience to better withstand severe weather. Maria Escorcia, JPMorgan Chase’s vice president of corporate responsibility for Florida, said the expanded MAP tool aligns perfectly with that goal, and could serve as a model for other coastal communities.

“JPMorgan Chase has a significant commitment to affordable housing and home ownership across the country but, obviously, with the unique challenges we have here in Miami, it was really important for us to take into consideration how climate change will impact affordable housing here, especially among communities of color,” Escorcia said. “Increasing affordable housing in our city and county starts with helping our leaders and developers identify viable and sustainable locations, and this MAP tool will help them rise to the challenge.”

A first-of-its kind, open-access, research tool with more than 200 filters, MAP initially combined local, state, and federal data on affordable housing to enable users to visualize the distribution of affordable housing, housing needs, and cost burdens across South Florida.

Originally created with funding from JPMorgan Chase and the Jesse Ball duPont Fund, it already has helped policymakers, developers, community organizations, and researchers encourage data-driven affordable housing analysis and solutions.

For example, officials with Miami-Dade’s Department of Public Housing and Community Development rely on MAP to allocate its federal affordable housing funds—and now they plan to use it when deciding how best to protect aging public housing from looming climate-related threats.

“We are currently in the process of making the county’s oldest public housing units more resilient to climate shocks and stresses,” said department director Michael Liu. “By overlaying sea-level rise risks with the supply of affordable housing, MAP 3.0 will enable us to better prioritize the adaptation of our most vulnerable properties.”

The CCE and JPMorgan Chase & Co. will publicly unveil the expanded MAP tool at a virtual event hosted by Lord on Tuesday, Dec. 8, at 1 p.m. To attend the event, register here. To access the MAP tool, visit CCE’s Miami Housing Solutions Lab.